Managing your bank organizational chart is a critical, yet often complex, responsibility. Whether you’re new to org charting or seeking ways to streamline an existing process, we will show you how to create, maintain, and leverage bank organizational charts as strategic tools, ultimately clarifying roles and driving organizational effectiveness within your bank.

Continue reading for a deep dive into banking job titles, responsibilities, and hierarchies (with a special focus on commercial and investment banks).

Table of contents

What Is a Bank Organizational Chart?

From managing complex financial transactions to ensuring regulatory compliance, a clear organizational framework is essential for any bank’s success. This is where the bank org chart comes in.

Many use bank org charts to show reporting relationships. While it certainly serves this basic function, a bank org chart is capable of much more. In fact, it’s a powerful tool that can drive strategic initiatives and improve operational efficiency across the entire organization.

Definition of a Bank Organizational Chart

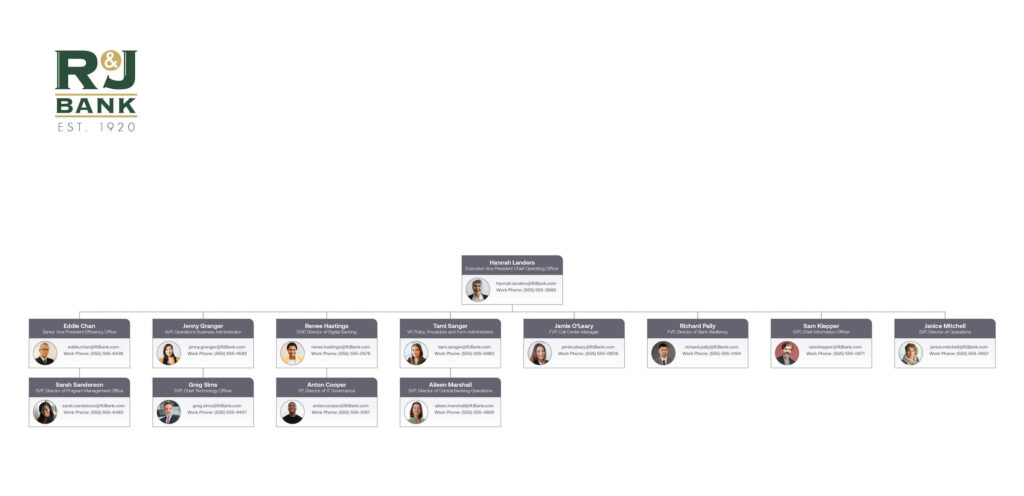

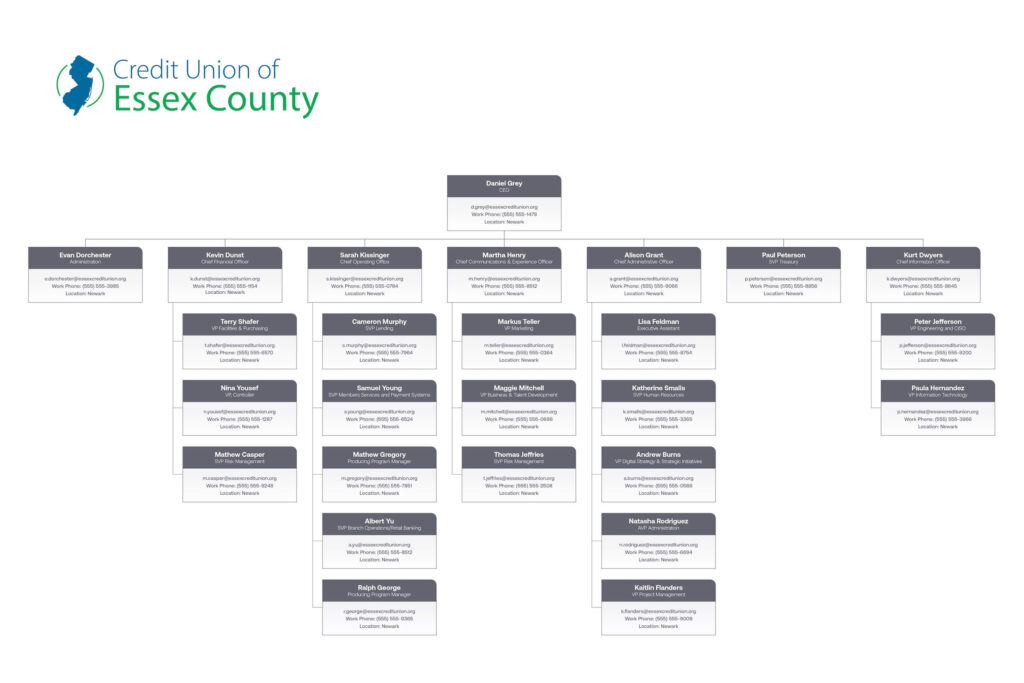

A bank organizational chart is a visual representation of a bank’s internal structure. However in some cases, your bank organizational chart may also include contractor roles as well.

Bank org charts graphically depict the hierarchy of a bank, its departments, and the reporting relationships within.

Think of it as the blueprint of your bank’s human capital. It illustrates not just the hierarchy, but also the interconnectedness of different departments and roles. By mapping out these relationships, a bank org chart becomes a valuable resource for a variety of strategic purposes.

Benefits of Visualizing Bank Structures

Banking organizational charts offer numerous advantages – aside from providing a visual representation of your employees – including:

- Clarifying Hierarchies and Departmental Functions: It helps us to visualize reporting lines and departmental divisions, identifying the chain of command and promoting transparency.

- Job Title and Responsibility Insights: Bank org charts can provide context for job titles, especially when integrated with other HR data sources. This can help leadership better understand role placement within the hierarchy and associated duties.

- Better Comprehension of Career Paths and Progression: The org chart can illustrate the distinct structures of commercial and investment banks, helping decision-makers and employees understand career paths and opportunities.

- Simplification of Complex Frameworks: Bank organizational charts transform complex organizational structures into easily digestible visuals, improving understanding of interdepartmental relationships.

Typical Structure of a Bank

Bank structures vary based on size, focus, and objectives, but some common elements exist. Understanding such commonalities is crucial for creating effective bank organizational charts.

Let’s explore typical departments and functions found in both commercial and investment banks. You’ll develop a clearer understanding of roles, enabling you to better visualize and represent your people within your own banking organizational chart.

Departments and Functions in Commercial Banking

Commercial banks focus on providing financial services to businesses and individuals. Their organizational structure typically includes the following key departments and functions:

| Department | Function or Role | Associated Job Titles |

| Retail Banking | Handles day-to-day banking needs for individual customers, including checking and savings accounts, loans, mortgages, and credit cards. | Branch Manager, Teller, Personal Banker, Mortgage Loan Officer |

| Business Banking, Commercial Lending | Provides financial products and services to businesses of various sizes, such as loans, lines of credit, and cash management solutions. | Commercial Loan Officer, Relationship Manager, Business Banking Specialist |

| Treasury Management | Helps businesses manage cash flow, including accounts receivable and payable, liquidity management, and fraud prevention. | Treasury Management Officer, Cash Management Analyst |

| Operations | Manages back-office functions such as transaction processing, check clearing, and account reconciliation. | Operations Manager, Transaction Processor, Data Entry Clerk |

| Customer Service | Provides support to customers through various channels, including phone, email, and online chat. | Customer Service Representative, Call Center Agent |

| Risk Management | Identifies, assesses, and mitigates financial and operational risks for the bank. | Risk Analyst, Credit Analyst, Compliance Officer |

| Marketing, Sales | Promotes the bank’s products and services to attract new customers and retain existing ones. | Marketing Manager, Sales Representative, Marketing Analyst |

| Finance, Accounting | Manages the bank’s financial records, prepares financial statements, and ensures regulatory compliance. | Accountant, Controller, Financial Analyst |

| Human Resources | Handles employee recruitment, training, benefits, and other HR-related functions. | HR Manager, Recruiter, HR Generalist |

Departments and Functions in Investment Banking

Investment banks focus on capital markets activities, providing advisory and financial services to corporations, governments, and institutional investors. Key departments and functions include:

| Department | Function or Role | Associated Job Titles |

| Investment Banking Division (IBD) | Advises companies on mergers and acquisitions (M&A), restructurings, and raising capital through debt and equity offerings. | Analyst, Associate, Vice President (VP), Director, Managing Director (MD) |

| Sales & Trading (S&T) | Executes trades for clients in various financial markets, including equities, fixed income, and derivatives. Sales builds client relationships, while traders manage the bank’s trading positions. | Sales Trader, Institutional Salesperson, Market Maker, Proprietary Trader |

| Equity Research | Analyzes publicly traded companies and provides research reports and investment recommendations to institutional investors. | Research Analyst, Senior Analyst, Research Associate |

| Fixed Income Research | Similar to equity research, but focuses on bonds and other fixed-income securities. | Fixed Income Analyst, Credit Analyst |

| Capital Markets | Originates, structures, and distributes new securities offerings (e.g., IPOs, bond issuances) to investors. | Origination Analyst, Syndicate Manager |

| Mergers & Acquisitions (M&A) | A core function within IBD, specializing in advising companies on buying, selling, or merging with other companies. | M&A Analyst, M&A Associate, M&A VP |

| Restructuring | Advises companies facing financial distress or bankruptcy on restructuring their debt and operations. | Restructuring Analyst, Restructuring Advisor |

| Private Wealth Management | Provides investment management and financial planning services to high-net-worth individuals and families. | Financial Advisor, Wealth Manager, Private Banker |

| Operations & Technology | Supports front-office functions with technology infrastructure, trade processing, risk management systems, and other operational needs. | Operations Analyst, Technology Specialist, IT Manager |

How Bank Size Impacts Organizational Structure

The size of a bank significantly influences its organizational structure and, consequently, the complexity of the bank organizational chart. Understanding these differences is crucial for creating and maintaining effective bank org charts.

Organizational Structure of Small Banks

Small community banks typically exhibit flatter organizational structures, and each manager may have a wider span of control.

A small bank org chart might feature a few key departments with direct reporting to the senior management team. These simpler structures often lead to shorter reporting lines and faster decision-making.

Organizational Structure of Large Banks

Larger banks often have complex, vertical structures with narrower spans of control and longer reporting lines. They may consist of specialized departments and divisions, each with its own hierarchy, creating a more intricate and multi-layered organizational chart.

These complex structures often require a more detailed and nuanced approach to bank organizational charting.

Tools for Large and Small Bank Org Charts

Regardless of size, every bank can benefit from using intuitive, data-informed org chart software to easily visualize and manipulate their org charts.

Modern software streamlines the process of creating, updating, and sharing org charts, saving valuable time and resources. Org chart software, like OrgChart, integrates with your HRIS to automatically populate charts with key employee data.

This integration allows you to include information such as salary, performance reviews, career progression, time until retirement, and other critical metrics directly within the org chart, transforming it from a simple visual representation to a strategic tool.

Ready to Visualize Your Bank’s Organizational Structure?

Discover how OrgChart helps financial institutions create clear, data-driven org charts that reveal reporting lines, department relationships, and career paths across every branch or division.

Investment Banking Hierarchy

Investment banking organizational structures can be particularly complex and nuanced, so it’s essential to grasp the ins and outs of these hierarchies to effectively manage talent, plan for succession, and ensure smooth operations. Let’s delve into the specific levels and roles within the hierarchy of investment banking.

Overview of Hierarchical Levels in Investment Banking

The typical hierarchy of investment banking follows a relatively standardized structure, progressing from entry-level positions to senior management. We’ve included some sample org charts to illustrate this.

To see how you can start creating your own investment bank org chart and leverage its power, book a demo with the OrgChart team today.

Entry-Level Positions and Career Progression

Entry-level positions in investment banking typically serve as a foundation for a long-term career within the industry. Common titles and their roles include:

- Analyst: Primarily responsible for financial modeling, data analysis, preparing presentations, and supporting senior bankers on deal execution.

- Intern: Usually a temporary position for students, providing exposure to various aspects of investment banking through shadowing and assisting on projects.

Facilitating career progression for entry-level employees is crucial since clear advancement paths and development opportunities are key to retaining top talent.

Senior Roles and Leadership Responsibilities

Senior leadership in investment banking carries significant responsibility for driving strategy, managing teams, and generating revenue. Key titles and their general responsibilities include:

- Vice President (VP): Manages deal teams, oversees project execution, and develops client relationships.

- Director: Leads larger teams or specific product/industry groups, focuses on business development and client management.

- Managing Director (MD): Holds ultimate responsibility for a business unit or a significant portion of the bank’s operations, focusing on strategic direction, client relationships, and revenue generation.

Investment banking org charts are invaluable for visualizing the true span of control and impact of each leadership position. These charts clearly show the number of direct reports, the size and scope of the department or division managed, and the overall influence of each leader within the organization.

Visualizing current leadership roles also facilitates proactive succession planning. By clearly mapping out reporting structures and identifying key talent within each team, organizations can better prepare for future transitions and ensure business continuity.

Investment Bank Org Chart vs. Commercial Banks

Let’s examine how investment bank org charts differ from those of commercial banks. This distinction is crucial, especially for HR professionals tasked with creating or managing investment bank organizational structures.

Understanding the differences ensures accurate representation of the firm’s unique structure, fostering buy-in from stakeholders, and ultimately, procuring clearer insights.

Overview of Organizational Differences

Here’s a comparison chart highlighting key organizational differences and their implications specifically for org charting:

| Org Charting Strategies | Investment Banks | Commercial Banks |

| Primary Focus | Optimize org charts with a deal team and/or client relationship focus. | Optimize org charts with a regional/branch or customer-facing focus. |

| Org Chart Structure | Hierarchical and project-based, with certain teams forming and disbanding frequently. Matrix structures are common, especially in larger firms. | Functional and departmentalized, with clear reporting lines. Flatter structures are more common in small community banks. |

| Org Chart Flexibility | Investment bank org charts often require dynamic updating to reflect changing deal teams. | Commercial bank org charts are often more static and require less frequent updates. |

| Roles and Departments | Org charts need to clearly delineate specialized roles and reporting within deal teams. | Org charts should emphasize departmental structures and functional responsibilities. |

| Career Progression | “Up-or-out” systems are common, with rapid advancement for high performers. Emphasis is on deal experience and revenue generation. | More linear and less rapid progression. Emphasis on experience, management skills, and customer relationship management. |

Key Roles Unique to Investment Banks

Several specialized roles are unique to investment banks due to their focus on capital markets and advisory services, significantly shaping their organizational charts.

- IBD: These roles drive deal execution and are unique to investment banks due to their focus on complex financial transactions like M&A and capital raising. Within an org chart, they reside within specific industry or product groups.

- Sales & Trading (Sales Trader, Trader, Market Maker): Sales builds client relationships and executes trades; traders manage the bank’s positions and make markets. They often have a completely separate division on the org chart.

- Equity/Fixed Income Research Analyst: Provides investment recommendations based on company or security analysis. This role typically resides in a research department, informing Sales & Trading, and helping to reflect information flow on the org chart.

- M&A Banker: These roles specialize in M&A and restructuring advisory. They often form a dedicated group within IBD on the org chart.

See How OrgChart Streamlines Complex Bank Hierarchies

Watch how banks can use OrgChart to simplify multi-division hierarchies, manage rapid organizational changes, and maintain compliance with accurate org charts.

Job Titles in Banking Industry: Navigating the Hierarchy

Understanding the nuances of job titles in the banking industry is crucial for accurately representing roles and responsibilities within your organizational charts. This section provides clarity regarding various levels, enabling you to confidently map your organization’s structure.

OrgChart software can automate much of this process, helping you create professional, sophisticated-looking org charts in minutes. Book a Demo today!

Skills and Qualifications for Entry-Level Roles

Rather than providing an exhaustive list of skills for every entry-level banking position, we’ve put together a framework for identifying the right qualifications that fit most organizations.

Step 1: Identify the Right Skills

Focus on relevant degrees and certifications, necessary technical proficiencies (like software and analytical skills), and crucial soft skills such as communication and teamwork, tailoring these to the specific entry-level role’s requirements.

Step 2: Leverage Your HRIS

Your HRIS is a goldmine of data for populating org charts with skills and qualifications. Pull key information, such as: education and certifications, skills and competencies, job titles and departments.

Step 3: Apply the Insights

Using this data, you can refine your hiring initiatives, identify skills gaps within current employees, and build more effective employee development plans.

Mid-Level Career Opportunities and Growth

Mid-level banking employees have various avenues for career progression, both within their current departments and across the organization. Most commonly, they can advance through vertical promotion, lateral promotion, or specialization.

It’s vital to help mid-level employees understand their potential next steps within the company. This transparency fosters engagement, motivation, and, ultimately, better retention.

Your organizational structure provides valuable insights into these potential paths and can aid in succession planning, high-potential identification, and organizational restructuring.

Executive-Level Roles and Leadership Paths

Visualizing executive-level roles and leadership paths is critical for strategic planning and organizational effectiveness. Rather than simply listing titles, it’s more valuable to understand how your org chart can facilitate analysis and planning at this level.

Modern org chart software like OrgChart can help you with the following:

- Understanding a Leader’s True Contribution: Org charts, especially when integrated with HRIS data, can reveal a leader’s impact beyond just their title. By visualizing the teams they manage, the projects they oversee, and the revenue they generate (if applicable), you gain a holistic view of their contribution to the organization’s success.

- Assessing Span of Control: Org charts clearly illustrate a leader’s span of control. This is crucial for analyzing managerial effectiveness. An excessively wide span of control can lead to burnout and decreased performance, while a too-narrow span can indicate the underutilization of resources.

- Charting How Leaders Help Achieve Organizational Goals: Bank organizational charts illustrate how each leader’s area of responsibility contributes to the overall strategic objectives of the bank. This visualization helps ensure alignment between individual goals, departmental goals, and the bank’s overarching strategy. It also helps identify bottlenecks or areas of improvement.

- Succession Planning: By visualizing the leadership structure and integrating performance data and potential ratings, org chart software can help identify potential successors for key leadership positions. You can also model different scenarios and see the impact on the organization.

Transitioning Between Banking Divisions

Employees may transition between banking divisions for career growth or organizational needs. These transitions can present challenges like differing skill sets, organizational cultures, and unclear reporting lines.

A clear org chart simplifies these transitions by clarifying reporting structures, visualizing interdepartmental relationships, and facilitating better communication.

With the help of sophisticated org chart software, you can also enable scenario modeling (visualize how moving employees impacts team structure and span of control) and gap identification.

Modernize Your Bank’s Org Chart with OrgChart

OrgChart helps banks by automating organizational structure updates and eliminating hours of manual work.

Popular features include automated or one-click data syncs, complete org chart customizations, flexible exporting options, and more.

Transform Your Bank’s Org Chart into a Strategic Advantage

Experience how OrgChart empowers financial institutions to deepen insight into reporting structures, streamline workforce planning, and ensure clarity.